In a historic year that marked a rapid plunge into bear market territory and a swift recovery into the bull zone, high-flying technology stocks and electric-vehicle pioneer Tesla Inc. were standout trades.

The S&P 500 Index went from peak to trough to peak again within 175 days as investors initially shunned most stocks in response to Covid-19 lockdowns and fears of prolonged recession, but later piled into stay-at-home beneficiaries. Since its pandemic-driven low, the benchmark has rallied 67%, smashing old records and adding $14 trillion in value.

Here’s a look at some of this year’s standout stock movers:

Tech Titans

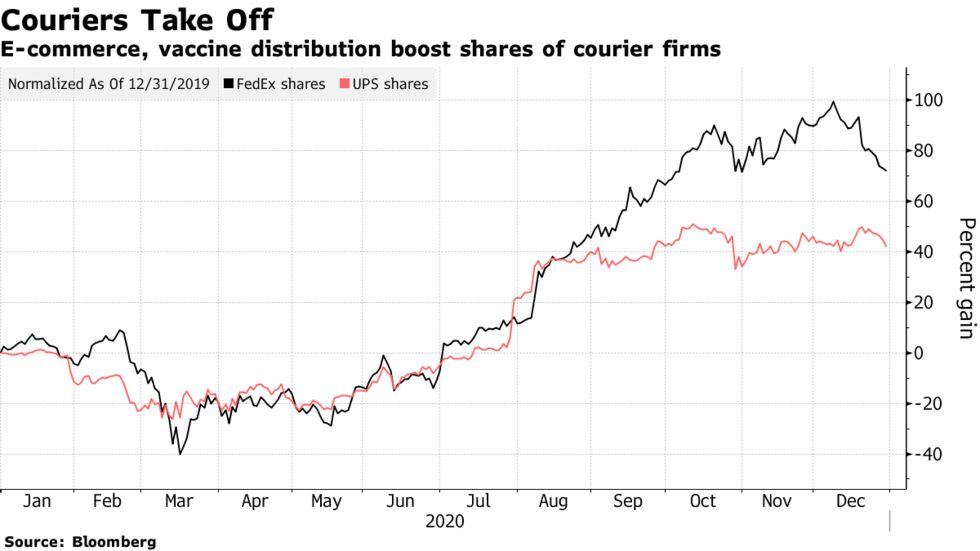

Large-cap technology stocks — led by Apple Inc., Amazon.com Inc. and Netflix Inc. — stoked major U.S. stock indexes to record highs in 2020, capitalizing on online shopping and a broader shift to the digital world.

A boom in e-commerce spending sent Amazon surging 78%, while Apple became the first-ever $2 trillion company amid strong demand for its iPhone 12 models and optimism about its self-driving car efforts. Stuck-at-home consumers spent more time streaming television shows and movies, sparking a rally in Netflix shares.

EV Boom

Tesla Tower

Tesla’s market capitalization dominates other automakers

Source: Bloomberg

Note: Figures are as of the market close on Dec. 30

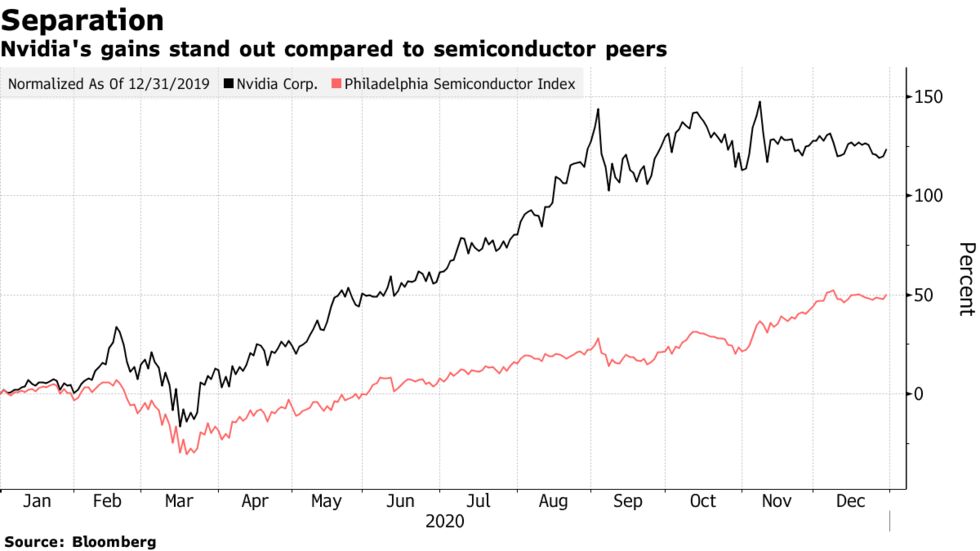

Believers in billionaire Elon Musk helped spark a 730% stock-surge in Tesla Inc., propelling the company’s market value to a dizzying $659 billion. Investor enthusiasm about the electric-vehicle maker’s addition into the S&P 500 and the prospect of higher growth for the sector as more consumers and policy makers embrace clean energy also helped fuel this year’s meteoric rise:

- Tesla is the top performer on the S&P 500, with its gains more than double those of the second-best stock, Etsy Inc.

- Its shares now account for about 1.7% of the index’s weight, lagging Apple, Microsoft Corp., Amazon and Facebook Inc.

- It’s also worth more than five times General Motors Co., Ford Motor Co., and Fiat Chrysler Automobiles combined.

Chips

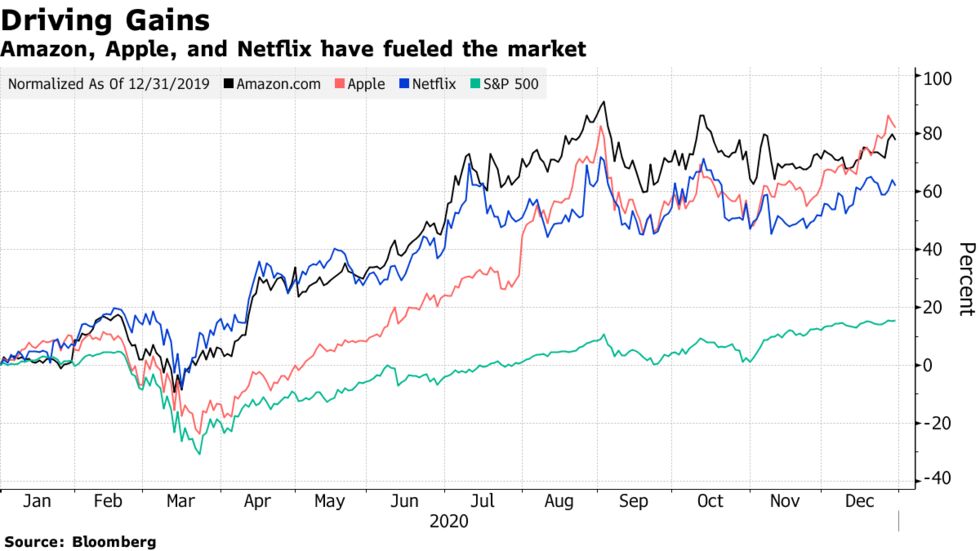

The pandemic boosted demand from semiconductors, leading to a 123% surge in the shares of Nvidia Corp., the maker of graphic processors that are used in everything from gaming to data center servers and artificial intelligence. That’s more than double the advance for the Philadelphia Semiconductor Index. Nvidia’s gaming business, which Morgan Stanley analysts have called “exceptional,” is expected to help fuel momentum into 2021 after quarterly sales crushed Wall Street expectations throughout the year.

Image Source: Tesla